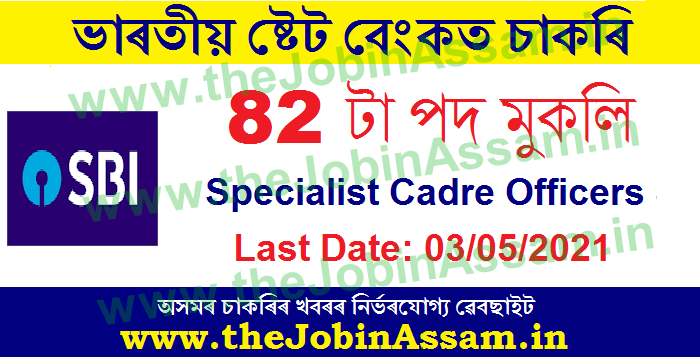

State Bank of India (SBI) Recruitment 2021

Last Date:

03/05/2021

State Bank of India (SBI) has invites application for the

recruitment of 82 Officer Cadre / Clerical Cadre / Specialist Cadre

Officer vacancy.

1. Data Analyst

No of posts: 8

2. Chief Ethics Officer

No of posts: 1

3. Advisor (Fraud Risk Management)

No of posts: 4

4. Deputy Manager ( Strategic Training )

No of posts: 1

5. Manager (Credit Analyst)

No of posts: 45

6. Manager (Job Family & Succession Planning)

No of posts: 1

7. Manager (Remittances)

No of posts: 1

8. Dy. Manager (Marketing –Financial Institutions)

No of posts: 1

9. Dy. Manager (Chartered Accountant)

No of posts: 6

10. Dy. Manager (Anytime Channel)

No of posts: 2

11. Manager (History)

No of posts: 1

12. Executive (Document Preservation–Archives)

No of posts: 1

13. Deputy Chief Technology Officer (IT–Digital Banking)

No of posts: 1

14. Manager (Risk Management)

No of posts: 1

15. Manager (Credit Analyst)

No of posts: 2

16. Senior Special Executive (Compliance)

No of posts: 1

17. Senior Special Executive (Strategy–TMG)

No of posts: 1

18. Senior Special Executive –(Global Trade)

No of posts: 1

19. Senior Executive (Retail & Subsidiaries)

No of posts: 1

20. Senior Executive (Finance)

No of posts: 1

21. Senior Executive (Marketing)

No of posts: 1

Educational Qualification:

Data Analyst: B.E/B. Tech/M.E/ M.Tech in Computer Science/ IT/ Data

Science/ Machine Learning and AI with min 60% .

Chief Ethics Officer: Minimum 20 years of experience (as on

01.04.2021) in Banking or Financial Institution or Corporate Sector, as well as

experience in the rank of General Manager or equivalent, preferably for 3 to 5

years .

Advisor (Fraud Risk Management): The Candidate should be a retired

IPS/State Police Officer not below the rank of Deputy Superintendent of Police

at the time of retirement. Should have worked in/handled Vigilance/ Economic

Offences/ Cyber Crime Department(s) .

Deputy Manager ( Strategic Training ): MBA/PGDM or its equivalent

as a full–time course. Preference will be given to candidates having

specialization in HR/Marketing .

Manager (Credit Analyst): Graduation in any stream, AND

MBA/PGDBA/PGDBM or their equivalent (with specialisation in Finance) as 2-year

regular course. Candidates having qualification of CA/CFA/ICWA(CMS) are also

eligible to apply. Minimum 3 years’ Post Qualification experience (as on

01.01.2021) in Corporate/ SME Credit as an executive in Supervisory/ Management

role in a Scheduled Commercial Bank/ Associate or Subsidiary of a Scheduled

Commercial Bank OR a Public Sector or listed Financial Institution/ Company.

Manager (Job Family & Succession Planning): Graduation in any

stream as full-time course, AND MBA/PGDM or its equivalent with Specialisation

in HR as full time course (as on 01.02.2021). Minimum 7 years’experience

(including internship, if any) in the field of Human Resource of working in

Banks/ NBFCs(as on 01.02.2021). Experience in the subfields such as Succession

Planning, Job Family, Decision Support Tool related to HRM will be preferred.

Manager (Remittances): Full Time B.E./B. Tech in any stream

(Electronics & Communication, Computer Science, Information Technology,

Electronics & Instrumentation etc.), AND Full Time MBA/PGDM or equivalent

Management degree(Preference will be given to candidates having Marketing

stream asmajor)[Course completed through correspondence/ part time will not be

eligible]. Minimum 4 years’ Post Basic Qualification experience (as on 01.01.2021)

in Scheduled Commercial Banks dealing with Foreign Inward Remittances

(preference will be given to candidates having experience in dealing with

Exchange Houses/ Banks).

Dy. Manager (Marketing –Financial Institutions): MBA/PGDM or its

equivalent 2-year full time course (Specialisation in ‘Marketing’is preferred).

Minimum 4 years’ Post Qualification experience (as on 01.01.2021) of working in

Marketing domain in Supervisory Capacity in Financial Institutions/ Banks.

Dy. Manager (Chartered Accountant): Chartered Accountant(preferably

passed in one attempt). Minimum 3 years’ post qualification experience (as on

01.02.2021) in Supervisory capacity in any Financial Institution/

Corporate/Bank.

Dy. Manager (Anytime Channel): BE/B.Tech in IT stream only

(Electronics & Communication/ Computer/ Electrical/ Information Science

etc.), AND Full time 2 years MBA/ PGDM or equivalent Management degree. Minimum

4 years’ composite experience (as on 01.04.2021) in the field of Banking,

Finance and/ with OEM or Audit in the Supervisory/ Executive or team member

capacity.(all work experience, internships before or after B.E./ B. Tech and

MBA/ PGDM will be considered under total workexperience).Out of total work

experience, minimum 3 years’experience should be in managing ATMs/ ADWMs/

Self-service Kiosks (SSKs) in Scheduled Commercial Banks/ Financial

Institutions or dealing with OEMs of ATMs/ ADWMs/ Self-service Kiosks in other

sectors.

Manager (History): Master of Arts (Economics) OR Master of Arts

(History) –full time course with 60% marks (First class) or equivalent to First

class as per university degree from UGC recognised universities / institutions.

Executive (Document Preservation–Archives): Graduate in science

(Chemistry) –full time course with 60% marks(First Class) or equivalent to

First class as per university degree from UGC recognised universities /

institutions.

Deputy Chief Technology Officer (IT–Digital Banking): B.Tech./ B.E./

M. Sc./M.Tech./MCA (from a recognized University/Institution). Minimum 15

years’ experience in IT field, preferably with software developer background.

Manager (Risk Management): MBA / PGDBM or its equivalent as full time

course from a recognised university/ institution. Specialisation in Finance is

preferred. Minimum 5 years of post-qualification work experience (as on

01.12.2020) in Risk management in Supervisory cadre in a Bank or Listed

Financial institution.

Manager (Credit Analyst): MBA/ Master’s Degree in Management / Post

Graduate Diploma in Management or their equivalents OR Chartered Accountant/

Cost Accountant. Minimum 5 yearsof post-qualification essential work experience

(as on 01.12.2020)in Credit related area in Supervisory Capacity in a Scheduled

Commercial Bank or Financial Institution.

Senior Special Executive (Compliance): Graduation in any discipline as

full time course from a recognized university/institution. Minimum 5 years of

post-qualification essential work experience (as on 01.12.2020) in any Banking

institution with overseas presence in any of the undernoted areas in

Supervisory capacity.

Senior Special Executive (Strategy–TMG): MBA /PGDBM or its

equivalent asfulltime course from a recognised university / institution.

Specialization in Finance is mandatory. Minimum 5 years of post-qualification

essential work experience(as on 01.12.2020) in Investment Banking activity

(Supervisory capacity) in areas related to treasury products and advisory at a

Foreign Bank / Private Bank / Public Sector Bank.

Senior Special Executive –(Global Trade): MBA/PGDM or its

equivalent as regular two-year programme from a recognised

university/Institute. Specialisation in Finance/Marketing is preferred. Minimum

4 years of post-qualification essential work experience (as on 01.12.2020)in

the domain of Finance/Marketing in Supervisory Capacity in a Bank.

Senior Executive (Retail & Subsidiaries): MBA/PGDBM or its

equivalent as full time course from a recognized University/Institution.

Specialisation in Finance is preferred. Minimum 3 years of post-qualification

essential work experience (as on 01.12.2020) in Banking/Finance in Supervisory

Capacity.

Senior Executive (Finance): MBA/PGDBM or its equivalent as full time

course from arecognized university/ institution. Specialization in Finance is

preferred. Minimum 3 years of post-qualification essential work experience (as

on 01.12.2020)in Banking/Finance in Supervisory Capacity.

Senior Executive (Marketing): PGDBM/ MBA or its equivalent as

full time course from a recognized University/ Institute. Specialization in

Marketing or Finance is preferred. Minimum 3 years of post-qualification

essential work experience (as on 01.12.2020)in the domain of Marketing /

Finance in Supervisory Capacity in PSU/Pvt Banks/MNCs. Working Knowledge of

International Trade Finance shall be preferred .

Interested and eligible candidates can

apply online for the above posts through the link given on Bank’s website https://bank.sbi/careers or https://www.sbi.co.in/careers from

13.04.2021 to 03.05.2021 .

- Starting date of

online application: 13th April 2021

-

Last date of online application: 3rd May 2021

Details Advertisement: Click Here

Apply Online: Click Here

..png)